Home Office Deductions 2025. Tax deductions for a home office will be dependent on the amount or percentage of the house converted into an office. The irs provides this tax benefit to both, homeowners and renters, who use part of their home exclusively for business purposes.

Many americans have been working from home due to the pandemic, but only certain people will qualify to claim the home office. Home office tax deduction for remote employees:

The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business.

Home Office Deduction Worksheet Excel Printable Word Searches, How small business owners can deduct their home office from their taxes. What is the home office deduction?

Home Office Deductions Here's how you can qualify for this benefit Marca, Under the tax cuts and jobs act (tja) of 2017, home office deductions for employees have been suspended for 2018 through 2025. Many americans have been working from home due to the pandemic, but only certain people will qualify to claim the home office.

Home Office Deductions One Click Life, The home office tax deduction for employees was eliminated in 2018 until at least 2025. Under the tax cuts and jobs act (tja) of 2017, home office deductions for employees have been suspended for 2018 through 2025.

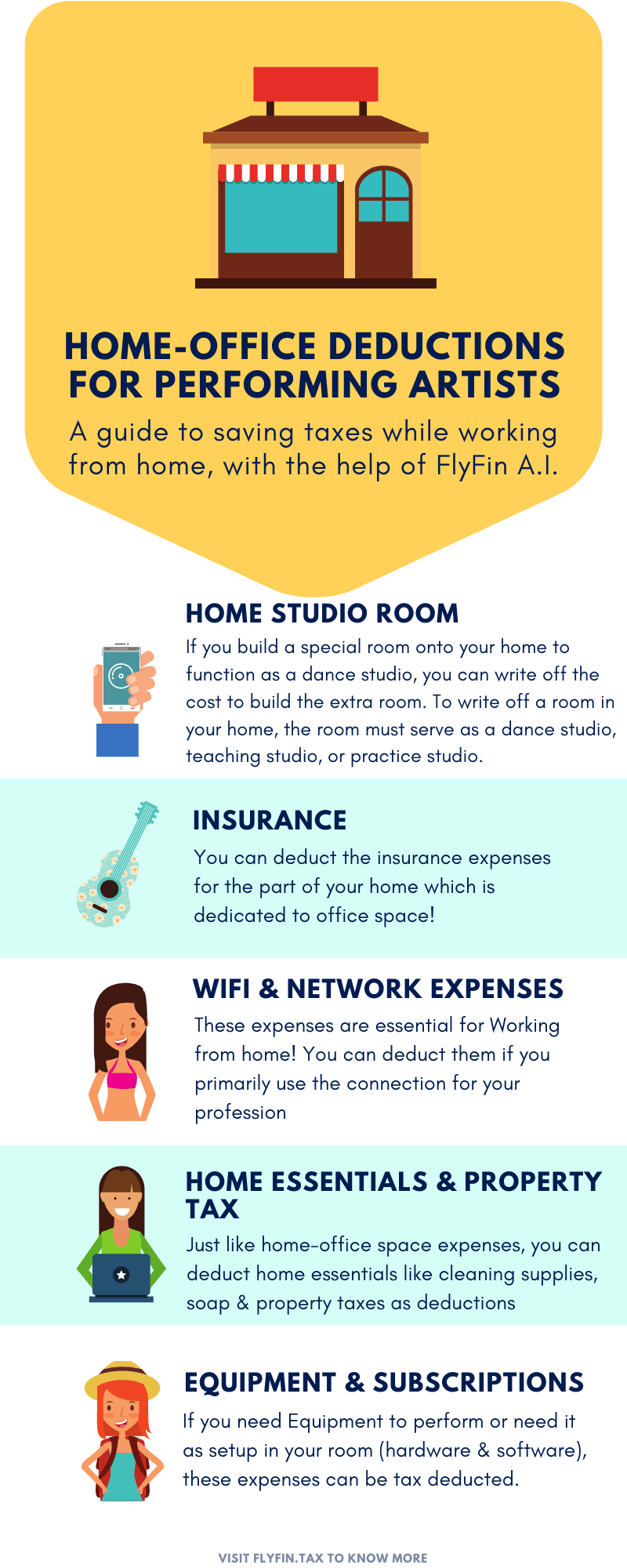

Home Office Deductions for Performing Artists Infographic Portal, Before 2018, an employee could apply a home office deduction to part of. The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business.

Home Office Deductions Rules for 2025 US Expat Tax Service, Before 2018, an employee could apply a home office deduction to part of. You can only claim the expenses you.

How to Qualify for Home Office Deductions Roger Rossmeisl, CPA, Let’s say your total home area is. Before 2018, an employee could apply a home office deduction to part of.

Home Office Deductions for Tax Year 2025, The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. You can only claim the expenses you.

Tax Deductions for Work from Home during Pandemic CPA, Your home can be a house, apartment, condo, or similar. Unfortunately, employee business expense deductions (including the expenses of maintaining a home office) are considered miscellaneous itemized deductions and are therefore disallowed from 2018 through 2025.

How to Calculate Home Office Deductions F&M Trust, Let’s say your total home area is. What is the home office deduction?

Teaching Tax Flow The Podcast 17 Home Office Deductions Explained, The home office deduction allows these workers to subtract the money they paid for home office expenses from their income, thus reducing their overall tax liability. It is important to measure if a part or the entire room is.

Under the tax cuts and jobs act (tja) of 2017, home office deductions for employees have been suspended for 2018 through 2025.